By A Mystery Man Writer

DataPath helps TPAs get where they want to grow through innovative solutions for CDH accounts, COBRA, billing, and well-being benefits.

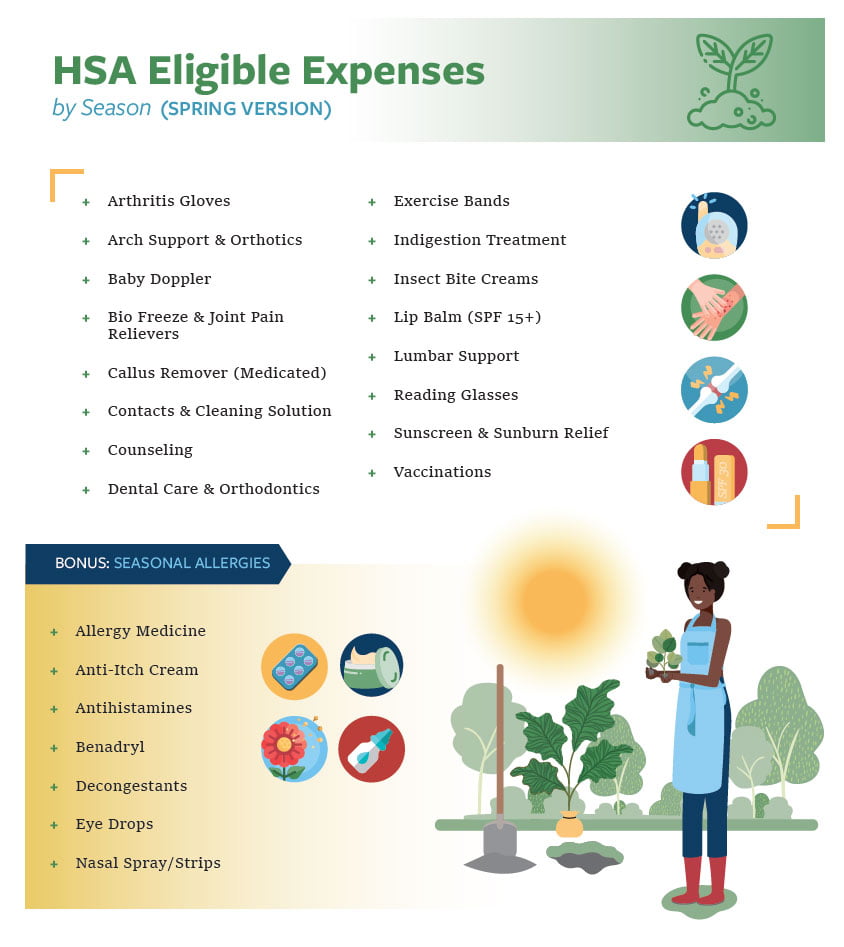

Since they were enacted in 2003, Health Savings Accounts (HSAs) have become an integral part of the consumer directed healthcare landscape for those with a high deductible health plan. One of the chief benefits of having an HSA is that account holders can use that money to pay for a wide range of eligible medical expenses for themselves, their spouses, and their tax dependents.

HSA Eligible Expenses 2023: What expenses can you use your HSA for?

13 FSA and HSA eligible expenses that may surprise you, EBA

/content/dam/pnc-thought-leadership/per

Health Savings Account - UNITED FAMILY BENEFITS

Eligible Expenses for FSAs, HSAs, and HRAs

Springtime HSA Eligible Expenses - Employee Benefits Management Group

84 HSA-Eligible Expenses You Can Save on This Year - GoodRx

:max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png)

Health Savings Account (HSA): How HSAs Work, Contribution Rules

16 Surprising FSA and HSA Eligible Expenses Your Employees Should Know About – Blue Horizon Benefits

Shrewd Spend HSA and FSA Accounts: What You Need to Know, flex spending eligible products only